4 Inactions That Cost You More Money Than You Know

Table of Contents

People make financial mistakes all the time, be it investing or selling at the wrong time, buying something they shouldn’t or couldn’t afford, or even racking up a huge debt on their credit card.

All these actions can affect you financially, and may even stop you from making proactive decisions about your money out of fear.

But did you know that inactions can also cost you money?

1. Not refinancing your home loan

As far as home loan refinancing is concerned, it is a matter of opportunism. The opportunity for greater savings and month-to-month cash flow can make refinancing worth it under the right circumstances.

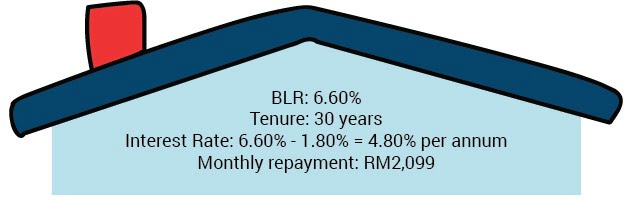

Let’s assume you took a RM400,000 home loan for a period of 30 years with BLR -1.80%, this would be your ongoing home loan repayment:

Now, after 10 years, you decide to refinance to a home loan package with a new rate of BR +1.35% for the remaining loan duration. In this case, your home loan repayment would change to:

Now, after 10 years, you decide to refinance to a home loan package with a new rate of BR +1.35% for the remaining loan duration. In this case, your home loan repayment would change to:

Upon refinancing, it will provide you with a savings of only RM600 on interest payment. While the savings you receive from refinancing your home loan with a lower interest rate may not be as significant, it will definitely provide you with a cash-out. With cash-out refinancing, you refinance your mortgage for more than you currently owe, then pocket the difference.

Upon refinancing, it will provide you with a savings of only RM600 on interest payment. While the savings you receive from refinancing your home loan with a lower interest rate may not be as significant, it will definitely provide you with a cash-out. With cash-out refinancing, you refinance your mortgage for more than you currently owe, then pocket the difference.

For example, if you refinanced your home loan for RM350,000, you will receive RM26,611 in cash. You can very well benefit from the cash-out by consolidating your debt, renovating your home, paying your child’s semester fees or even going on a family vacation.

2. Not paying off credit card debts

Did you know that by making just minimum or partial repayment for your credit cards every month, you are incurring interest payments? The extra money could have otherwise been used to purchase critical item like insurance, investment or even the down payment of a property.

Let’s say you have an outstanding amount of RM6,000 on your credit card, here’s how much interest payment you would incur if you don’t fully pay it off:

If you take advantage of various repayment facilities such as easy payment plan or balance transfer, you could still split up your big credit card debt into monthly payments and still pay zero or less interest:

If you take advantage of various repayment facilities such as easy payment plan or balance transfer, you could still split up your big credit card debt into monthly payments and still pay zero or less interest:

3. Not investing your savings

Let’s assume you have saved up or inherited a windfall of RM100,000 from a long lost relative. What you decide to do, or not do with that money, will impact your finances differently.

If you decided to hoard the cash for only reasons you know you will definitely suffer a loss, due to the rising inflation.

If you choose to invest that money at the right time, and on the right things, you could possibly make some money from it. If you had chosen to invest your money, in one year your new balance could have been:

4. Not selling your investment

Investing your money is a good move to sustaining and protecting your wealth. However, blindly holding on to your investment can prove to be detrimental to your finances.

If you had invested into some 10,000 unit of shares and you first bought them for RM4.20 per unit (therefore, total investment = RM42,000). Later, due to some economic downturn, share prices start dropping and your share value drops to RM4.05 per unit, and you are still contemplating whether to sell or hold hoping that it would rise again.

But unfortunately it drops further to RM3.95 per unit. If you had decided to sell it earlier, you would have made only RM1,500 loss. Now, the loss has accumulated to RM2,500.

Don’t push away financial decisions out of fear

Many of us try to push away any major financial decisions out of fear. However, not doing anything with your money can sometimes lead us to even worse fate than before.

The actual number of people who make a proactive improvement to their finances by taking part in these opportunities is likely to be low. Even the best intentions are rarely realised, and over the course of the year there are likely to be many financial distractions.

Sometimes, you are afraid that decisions you make impulsively without much thought put into it can cause you to lose money. But never forget that opportunities you foolishly did not take advantage of can also costs you money.

Not making timely decisions equally imposes negative impact on your long-term finances. Always keep a look out for financial opportunities that you can take advantage of to reduce your financial burden and be on way to the glory of financial freedom.