BSN Credit Cards

BSN offers great reward points especially with the BSN Gold Card, users can enjoy 2x Happy Rewards points with retail spending with an amazing balance transfer program of 0% interest rates in 6 months. Compare all BSN credit cards and apply online today.

We found 10 credit card(s) for you!

Here's some popular credit cards for your reference!

BSN Platinum MasterCard / Visa

Redeem accumulated Happy Points for BIG Points, Enrich Points, exciting gifts, retail vouchers and so much more.

- Min. Monthly Income

- RM 4,000

- Annual Fee

- Free

- Cashback

- -

BSN Gold Card

Enjoy the rewards when you travel or just sit at home. Use this card to shop, eat or travel at any time.

- Min. Monthly Income

- RM 3,000

- Annual Fee

- Free

- Cashback

- -

BSN Classic Card

Enjoy as low as 11%p.a. finance charge for prompt minimum payment for 12 consecutive months & get a complimentary BSN Zing PLUSMiles Touch ‘n Go card.

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- -

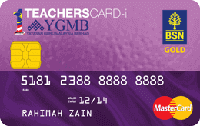

BSN 1 TeachersCard MasterCard Credit Card-i

Shariah-compliant card specially forged for teachers in Malaysia. Receive rewards every time you shop while contributing 0.2% to YGMB!

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- -

BSN Classic Card-i

Enjoy as low as 11%p.a. finance charge for prompt minimum payment for 12 consecutive months & get a complimentary BSN Zing PLUSMiles Touch ‘n Go card.

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- -

BSN Platinum Credit Card-i

With this card you earn up to 2x BSN Reward Points with all retail spending, and Travel Accident insurance coverage of up to RM300,000!.

- Min. Monthly Income

- RM 4,000

- Annual Fee

- Free

- Cashback

- -

BSN Gold Credit Card-i

All your overseas retail spending will be rewarded with up to 2x BSN Reward points, included with Travel Accident insurance coverage of up to RM300,000!

- Min. Monthly Income

- RM 3,000

- Annual Fee

- Free

- Cashback

- -

BSN UUM-BSN Gold Credit Card-i

This card rewards up to 2x BSN Reward points with all retail spending, and get covered with Travel Accident insurance of up to RM500,000!

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- -

BSN 1 TeachersCard MasterCard

Collect and redeem exciting prizes through the BSN Happy Rewards Programme - vouchers, gadgets, home appliances, and more!

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- -

BSN UUM-BSN Platinum Credit Card-i

Use it at over 29 million merchants and 1 million ATMs worldwide, enjoy Happy Points and many more card facilities.

- Min. Monthly Income

- RM 5,000

- Annual Fee

- Free

- Cashback

- -

Balance Transfer to any BSN credit cards

Other Credit Card categories

Still unsure about which product best suits you?

Leave your details and our friendly agents will get back to you!

How do you apply for a credit card online?

Step 1

Use our Credit Card Smart Search to find a list of cards that fits your needs! Choose the one you are interested in.

Step 2

Once you fill in your contact details, we will call you to help you apply!

Read more about Credit Card

FAQs Why apply for a BSN credit card?

BSN credit cards cater to those who enjoy savings while using their credit cards. They offer a range of discounts for customers, with additional privileges for those who need a little extra something special.

-

Unify your credit card payments into a single monthly bill with your BSN credit card. BSN’s Balance Transfer Programme makes it easy for you to consolidate your payments, while the Auto Balance Conversion Programme gives you a lower monthly bill than competing products.

-

Get free supplementary cards, cashback and amazing privileges from merchants around the country.

Make use of the BSN EasyPay Plan to make interest free instalment payments on your purchases. Balancing your budget and taking the sting out of unexpected expenses.

-

Convert your BSN Happy Rewards into Enrich Miles or AirAsia BIG Points. Spend with your credit card to earn flights to your dream destinations.

-

BSN offers the BSN G-Card Visa Credit Card and the BSN-Teachers Mastercard Gold for additional discounts and privileges for government servants and teachers. Get rewarded for your service to the country.

-

Simply apply online with iMoney. Select the credit card you want and fill in your contact details in the form provided. Our representative will contact you to guide you through the application process.