AmBank Credit Cards

AmBank has a series of great benefits from travel, dining promotions and entertainment privileges. Aside from annual fee waiver package offered by AmBank, you can collect massive points and redeem up to 10x points on retail transaction. Compare all AmBank credit cards and apply online today.

We found 10 credit card(s) for you!

Here's some popular credit cards for your reference!

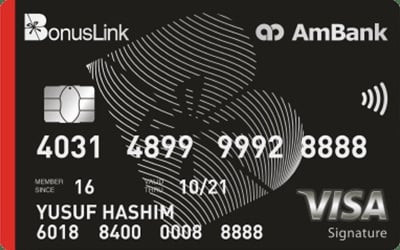

AmBank/AmBank Islamic Visa Signature Card

Earn 3 AmBonus Points for every RM1 spent overseas, and also enjoy exclusive dining and travel privileges!

- Min. Monthly Income

- RM 6,667

- Annual Fee

- Free

- Cashback

- N/A

AmBank Islamic Visa Platinum CARz Card

Earn 1 AmBonus Point for every RM1 you spend and up to 20% cash rebate on worldwide spending.

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- RM80/mth

AmBank Cosway Gold MasterCard

Enjoy earning up to 3x Cosway Points to be redeemed at over 850 Cosway outlets around Malaysia!

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- -

AmBank/AmBank Islamic Visa Platinum Card

Great for those who travel a lot, as you earn extra AmBonus Points for your overseas retail spending! Also get complete travel insurance coverage of up to RM1,000,000!

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- N/A

AmBank Carz Gold Visa Card

Earn up to 3% cashback on your petrol expenditure.

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- RM50/mth

AmBank Gold MasterCard / Visa Card

Earn AmBonus Points from your retail spending, and also get complete travel insurance coverage of up to RM500,000!

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- N/A

AmBank/AmBank Islamic Visa Infinite

For every RM1 spent overseas, you earn 5 AmBonus Points! And also enjoy exclusive travel and dining privileges too!

- Min. Monthly Income

- RM 10,000

- Annual Fee

- Free

- Cashback

- N/A

Balance Transfer to any Ambank credit cards

Other Credit Card categories

Still unsure about which product best suits you?

Leave your details and our friendly agents will get back to you!

How do you apply for a credit card online?

Step 1

Use our Credit Card Smart Search to find a list of cards that fits your needs! Choose the one you are interested in.

Step 2

Once you fill in your contact details, we will call you to help you apply!

Read more about Credit Card

FAQs Why get an AmBank credit card?

AmBank credit cards give you access to a range of exclusive perks. Couple that with a great points programme, and you have contenders for some of the best rewards credit cards in Malaysia.

-

Most AmBank credit cards will reward you with AmBonus Points for your spending. Basic cards like the AmBank Visa Platinum card reward you with 1 point for every RM1 you spend, while premium ones like the Visa Infinite card give you 5 points for every RM1 you spend overseas.

Here’s how you can use your AmBonus Points:â— Redeem Enrich, Asia Miles, AirAsia, KrisFlyer air miles

â— Redeem vouchers for Isetan, Tesco, Giant, Cold Storage, Popular, Lazada, Grab, Agoda, Shopee, Zalora, Touch 'n Go eWallet and more

â— Redeem lifestyle items like phones, iPads, computer accessories, kitchen appliances and more

â— Pay for purchases at participating outlets -

When you shop at a participating outlet, you can convert your retail purchase to the 0% Easy Payment Plan. This allows you to break up your purchase into smaller, monthly repayments across a tenure of 6 to 24 months (subject to AmBank’s approval). This plan is available at 700 participating outlets.

-

The AmBank Cash Rebate Visa Platinum card offers up to 8% cash rebates on groceries, pharmacies and online spending. This is relatively high compared to other credit cards, which makes this a good cashback card for everyday spending.

-

AmBank’s premium cards, such as the AmBank Visa Infinite card or World Mastercard, offer a range of exclusive perks. This includes 1-for-1 dining deals at the Shangri-La Hotel Kuala Lumpur, airport lounge access in over 50 countries, dining and accommodation benefits at Club Marriott, complimentary travel insurance, concierge services and more.

But you don’t have to spring for the most premium cards to enjoy these privileges. Even the AmBank BonusLink Visa Card, which has a minimum income requirement starting at only RM2,000 a month, gives you access to these perks.

Besides that, all AmBank cardholders are also entitled to seasonal credit card promotions. AmBank has a huge catalogue of promotions for merchants like Zalora, Lazada, HappyFresh, Agoda and more! -

Simply apply now online with iMoney. Select the credit card you want and fill in your contact details in the form provided. Our representative will contact you to guide you through the application process.