Housing Withdrawals At Your Fingertips

A decade ago, FIABCI found property prices in Malaysia were still very affordable and property buyers between the ages of 28 to 38 could put a down payment with the help of their parents or from their own savings. Today, prices are two to three times more, and the percentage of young buyers has dipped some 20% as salaries don’t commensurate with sky-rocketing property costs. These young buyers are also going for new developments. They’re price conscious, particular about location, and purchase within their means.

To fund their home financing commitments, property owners can make housing withdrawals from their EPF account. This withdrawal comes from Account 2, which is about 30% of the fund. If you have RM90,000 in your EPF, you can withdraw up to RM30,000.

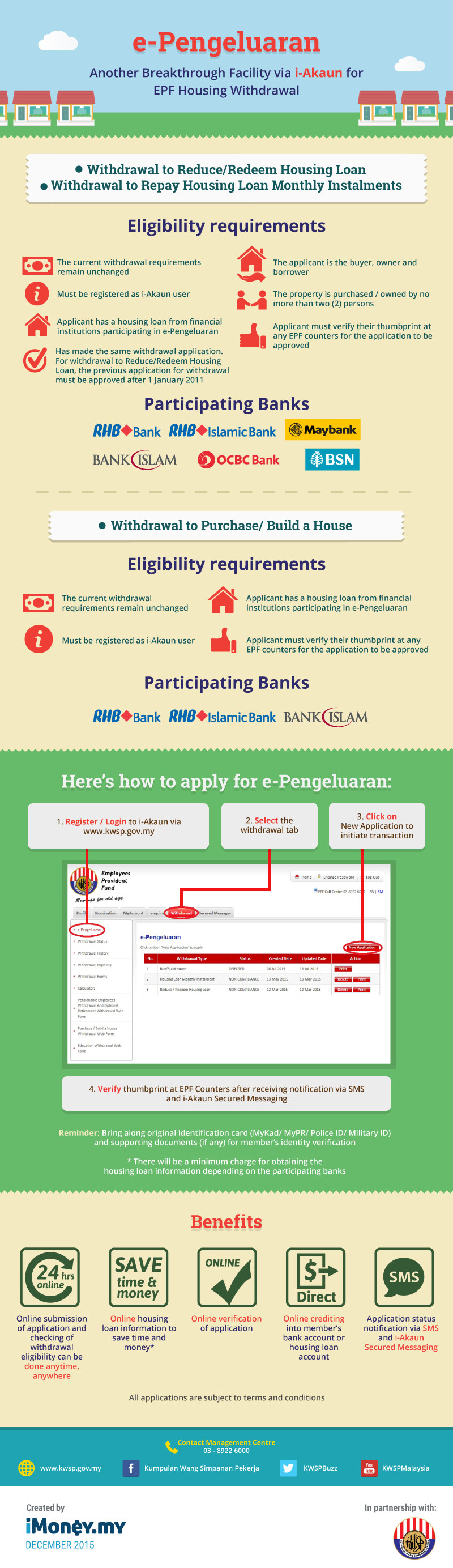

You can make withdrawals, or e-Pengeluaran for the following reasons:

1. Withdrawal to purchase/build a house

2. Withdrawal to reduce/redeem a housing loan

3. Withdrawal to pay down housing loan monthly instalment

To apply initially, you need to walk in to any EPF office to submit the forms you have filled up manually, along with the supporting documents or submit via postal services. Now, with e-pengeluaran under the i-Akaun, you can now manage your withdrawal applications on-line. This saves time, reduces your hassle and is more secured.