Taking The First Step To Your First Million Ringgit

This article is sponsored by Securities Commission Malaysia, under its InvestSmart initiative

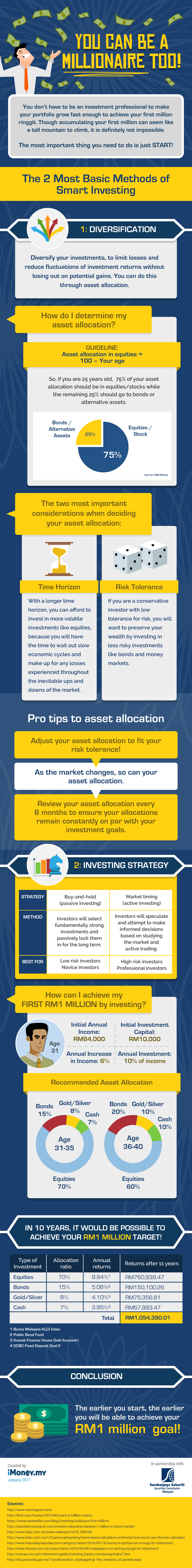

Who doesn’t want to become a millionaire? Though the goal is clear, but the path can be tumultuous and slow. For all you know, you might even be going on the wrong path.

Many of those in the affluent category would tell you that making your first million is easy. The tough part is when you want to make many more millions after that.

For most of us on the non-millionaire list, that does not seem true at all. Earning RM5,000 a month is not getting us anywhere close to RM1 million.

The truth is, there are two parts to achieving your goal. One is to earn more, while the other is to make what you have work even harder for you.

Earning more sounds good, but you also need to know how to save your money and put your savings into overdrive. Simply putting your savings in a fixed deposit account that promises 3.00% per annum is probably not going to help you achieve that dream.

Invest your savings wisely to take the first step towards the path of millionaire. The earlier you start, the nearer you are to your dream.

© Securities Commission Malaysia (SC). Considerable care has been taken to ensure that the information contained here is accurate at the date of publication. However no representation or warranty, express or implied, is made to its accuracy or completeness. The SC therefore accepts no liability for any loss arising, whether direct or indirect, caused by the use of any part of the information provided. The information provided is for educational purposes only and should not be regarded as an offer or a solicitation of an offer for investment or used as a substitute for legal or other professional advice. For enquiries regarding sharing, republishing or redistributing this content please write to: admin@investsmartsc.my.