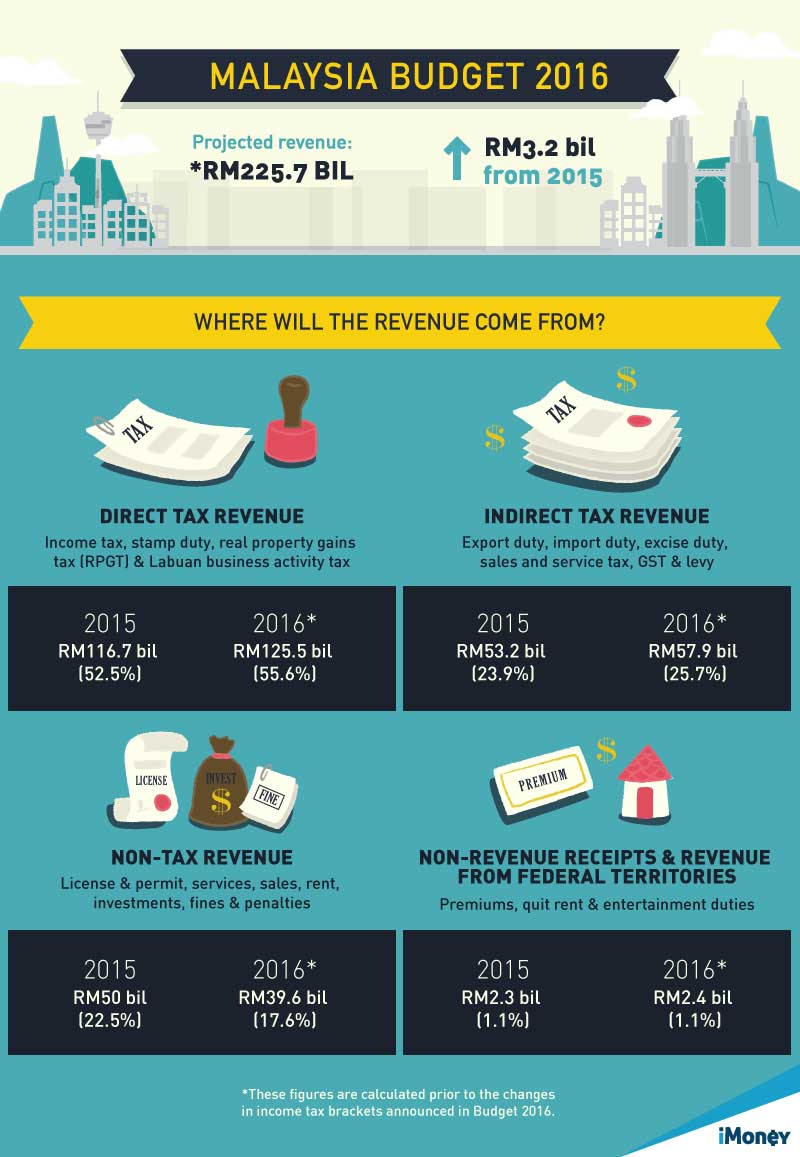

Budget 2016: Where Will The Government Get Its Revenue From?

The 2016 budget was tabled by our Prime Minister, Datuk Seri Najib Tun Razak on October 23 and estimates a revenue of RM225.7 billion for the upcoming year.

This will mark an increase of RM3.2 billion from Budget 2015. But where will the money come from?

One of the Government’s main revenue sources will no doubt come from collection of the Goods and Services Tax (GST), which is estimated to hit RM39 billion in 2016.

While revenue from GST has made up for the country’s shortfall in oil and gas earnings, many Malaysians are now feeling the pinch from the rising cost of living that has partly been a result of the tax’s implementation.

In these challenging economic times, many Malaysians, especially those from the low and middle-income groups, have resorted to drastically cutting back on expenses to tackle more expensive living costs.

However, taking austerity measures isn’t the only way you can combat rising costs. You can stretch your Ringgit further and make your money work just that much harder for you when you use a credit card that rewards you for your lifestyle.