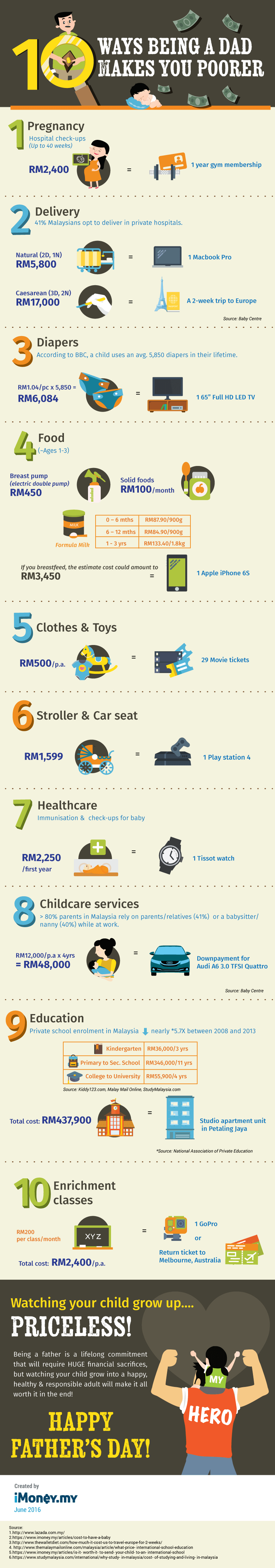

10 Ways Being A Dad Makes You Poorer

Everybody knows that it’s expensive to raise a child, but just how much would it cost you?

How much does the average Malaysian dad spend from the time of their child’s birth to when he or she goes to university?

The scary truth is, the cost of raising children is staggering and probably far more than what most (single) people can imagine!

For instance, you could be paying RM12,000 every year for babysitting services alone – that’s roughly the cost of a down payment for a brand new Audi A6! And we’re looking at just one aspect of the bigger picture, as these costs will surely escalate as your child grows older.

However, as the saying goes: Being a parent isn’t about what you’ve had to give up from having a child, but what you’ve gained from having one.

For many parents, the biggest reward comes from watching their children grow into happy, healthy and responsible adults, and this makes every penny worth it!