You don’t need to be a money expert to start saving money and reining in your spending. In many ways, saving money is like going on a diet. When you want to lose weight, you have to change your lifestyle, including your diet and exercise regimen. There are a million fad diets but we all know that in reality the only way to lose weight is through healthy diet and exercise.

Similarly, saving money is all about having the will power to spend less and make more. In order to do that, one needs to change their lifestyle.

If you find yourself in dire straits, these 5 quickest ways to save money may just turn your financial situation around.

1) Cutting back

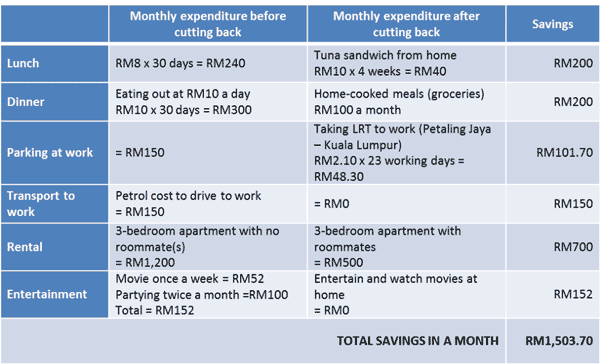

The first step to save money is to reduce your expenses. Before you begin, look at where your money is going and figure out where you can cut back. For example, if you spend RM800 a month to rent an apartment, you can cut down or even eliminate this expenditure by either moving back in with your parent’s or look for a roommate to share the rent.

There are limitless ways to save money. The key is not to starve yourself suddenly and completely (going cold turkey) but to reduce your spending gradually.

Here’s an example of how changing your lifestyle can help save some cash.

Estimated monthly expenditure and projected savings

2) Increase your income

You’re out of cash. What do you do? In addition to reducing your expenses, you need to boost your income. After all, no matter how good a money saver you are, a bit more is always useful.

To increase your salary, think about doing a job that pays well. To look for the highest paying jobs in Malaysia, see our infographic.

However, if you are not planning to look for a new job, you can always start discussing with your boss on your performance and target with the aim of getting an increment.

Other ways to increase your income is to consider working part-time, such as writing freelance, starting a blog and teaching tuition classes. Choosing the right part-time job to do depends on your preference and expertise.

If you are into scrapbooking, you can even advertise your service on Facebook for free to get some extra income. The world is your oyster when it comes to making a few bucks.

3) Make money from trash

We’ve said it before and we’re gonna say it again, sometimes just cutting your spending is not enough. To take it a step further, you can consider making some money by selling unused items. There are forums, Facebook groups and websites that cater to swapping and selling pre-loved items.

Money is a strong motivation to finally start on that spring cleaning you’ve been putting off. If you find your closet bursting at the seams to accommodate all your clothes, go through them and sell whatever you don’t want to wear anymore (provided they are still in good condition).

Every extra ringgit brings you one step closer to your goal, so get creative!

4) Get rewarded every time you spend

Saving money doesn’t mean living the life of a monk. You can still indulge once in a while. There is no harm in dining out on special occasions, or pamper yourself with retail therapy. The key is to know how to get the most out of your money and finding the best deal.

One of the ways to shop at a discounted price is to shop online. Most items are cheaper online as the operational cost for an online shop is much lower than a physical shop. Furthermore, you can get into the habit of clipping virtual coupons.

Some of the well-known e-commerce websites offer voucher codes with discount. Instead of scouring the Internet for these vouchers, you can keep updated on the latest deals and vouchers through website like iPrice.my. All voucher codes are updated daily on the site to ensure that you don’t miss any opportunities to save some money.

Another way to get rewarded for spending is by using your credit card. Pay attention to the rewards and discounts offered by your card. You can easily earn cash back and reward points by shopping at the designated shops. Compare and apply for one that best suits you now with our online credit card application and comparison page.

5) Magic of compounding interest

After cutting back and boosting your income, leaving all your money in a tin box under your bed is not going to do you any good. Make your effort in being frugal and smart with your money count by getting some help from compounding interest.

Some of the ways you can save money and earn interest on it are:

1) Fixed deposit account – A convenient and risk-free alternative to bonds, fixed deposits are the go-to investment for people who wants relatively low-risk investment vehicle or saving method with higher interest rates.

2) Unit trust fund – Investing in unit trust funds is relatively low-risk as a fund manager will be appointed to ensure the investor’s portfolio is diversified.

Sometimes a goal can spur these quick money saving moves, such as saving for a holiday or buying a home. However, there’s a pretty good chance that once you make these changes, you won’t ever go back to your old ways.

Just like people who want to lose weight learn to eat better and exercise more, with these money saving methods, you may just learn how to manage your money like a pro.