Alliance Bank Credit Cards

Alliance Bank offers you a great diversity of card benefits which include rewards points, cashback and air miles. With Alliance Rebates You:nique Card, you can earn up to 3% unlimited cashback on retail spending. Otherwise, you can enjoy up to 5x Timeless Bonus Points (TBP) for every RM1 spent with Alliance Visa Infinite. Convert your TBP into Enrich miles or BIG points to claim FREE flight for your holiday!

Exclusive Offer!

Apply for an Alliance Visa Credit Card today!

Enjoy RM400 or RM200 Cashback when you activate.

We found 3 credit card(s) for you!

Here's some popular credit cards for your reference!

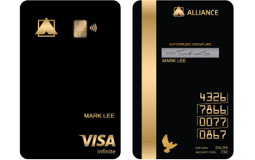

Alliance Bank Visa Infinite Credit Card

*Terms and conditions apply

- Min. Monthly Income

- RM 5,000

- Annual Fee

- Free

- Cashback

- -

Alliance Bank Visa Platinum Credit Card

*Terms and conditions apply

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- -

Alliance Bank Visa Signature Credit Card

Enjoy up to 5% Cashback On All Retail Spend i.e. Online Shopping, Petrol, Grocery, Dining, Utilities & Other Retail Spending

- Min. Monthly Income

- RM 4,000

- Annual Fee

- Free

- Cashback

- Up to 5%

Balance Transfer to any Alliance Bank credit cards

Other Credit Card categories

Still unsure about which product best suits you?

Leave your details and our friendly agents will get back to you!

How do you apply for a credit card online?

Step 1

Use our Credit Card Smart Search to find a list of cards that fits your needs! Choose the one you are interested in.

Step 2

Once you fill in your contact details, we will call you to help you apply!

Read more about Credit Card

FAQs Why get an Alliance Bank credit card?

Alliance Bank credit cards boast a strong rewards programme that can be even more rewarding when you use the bank's other financial products. They also offer attractive balance transfer rates and annual fee waivers.

Alliance Bank is holding a lot of promos right now for their credit cards. If you apply for one of their Visa Infinite, Platinum, or Visa Signature credit card, you can get up to RM600 cashback.

-

Alliance Bank credit cards come with rewards and privileges designed for every lifestyle. You can earn cashback, Timeless Bonus Points, and enjoy balance transfer offers at attractive rates. Depending on the card type, you can also access travel perks, insurance coverage, and lifestyle discounts.

-

You can apply for an Alliance Bank credit card through iMoney’s secure application form. Simply select your preferred card, fill in your details, and a bank representative will contact you to complete the process.

Eligibility requirements:

- Malaysian citizen aged 21 years and above (primary card)

- Minimum income from RM2,000/month (for entry-level cards)

- Valid supporting documents (IC, payslip, or income proof)

-

Income requirements vary by card type:

- Basic / You:nique Gold / Platinum: from RM2,000 monthly income

- Signature: from RM4,000 monthly income

- Visa Infinite: from RM5,000 monthly income

-

- Interest rate: It can range from 9% to 15% p.a. for prompt payers, depending on the credit card, and up to a maximum of 18% per annum

- Service tax: RM25 per card, per year

- Late payment charge: minimum RM10 or 1% of the total principal outstanding balance

- Cash advance fee: 1.25% of the cash advance amount or a minimum of RM3 (whichever is higher) per transaction

Annual fees are waived for the first year.

As of 1 August 2025, Alliance Bank has discontinued the minimum-spend requirement for fee waivers. A lifetime annual-fee waiver now applies to Alliance Privilege Customers and to cardholders who maintain a home-financing facility with Alliance Bank.

The supplementary card is free of charge (no annual fee).

-

Annual fee is only waived for the first year. The previous “minimum number of swipes” and “minimum spend” waiver conditions have been discontinued.

As of 1 August 2025, annual-fee waivers apply only if you qualify as either:

- An Alliance Privilege customer (with at least RM300,000 in net investable assets), or

- An Alliance Personal customer (with at least RM100,000 in combined deposits or investments, or holding a home-financing facility).

If you don’t fall into either category, the standard annual fee of RM148 will apply starting from your second year.

-

Alliance Bank regularly offers cashback and welcome promotions. Currently, iMoney offers an exclusive reward of RM400 or RM200 cash back when you apply and activate your Alliance Bank credit card.

View the Alliance Bank promotions terms and conditions for full details of the campaign.

-

You can transfer balances from other credit cards to your Alliance Bank card at low promotional rates starting from 0% p.a. for six months (for new-to-bank customers), then as low as 9.88% per annum for up to 24 months.

Terms:

- Flexible tenures: 6, 9, or 12 months

- One-time processing fee may apply

Minimum transfer amount: RM1,000

-

Alliance Bank offers up to 5% unlimited cashback on everyday spending, with potential for additional cashback rate of up to 3% depending on certain criteria.

- You:nique Gold Card: up to 3% on all retail purchases without any restrictions

- Visa Signature: up to 5% on all retail purchases and online shopping, including transactions made with Google Pay and Samsung Pay

- Privilege Visa Signature: 5% cashback on all retail spending, plus additional 3% cashback based on certain terms and conditions

Cashback is credited to your next statement automatically.

-

The only way you can check your credit card application status with Alliance Bank is by calling their customer service number at 03-5516 9988.

-

There are many ways you can pay your Alliance Bank credit card bill, which include;

- Cash or cheque at Alliance Bank branches nationwide

- Standing instruction (via deduction from your Alliance Bank savings or current account)

- Cheque Xpress/Cash deposit machines at selected branches

- Internet banking via allianceonline

- Automated teller machine (ATM)

- MEPS IBG at participating financial institutions

-

You can pay your Alliance Bank credit card bill through several convenient methods:

- Online banking via Alliance Online, FPX, or another bank that is part of the Paynet network

- Mobile wallets like Google Pay and Samsung Pay, and JomPAY

- Cash/cheque at Alliance Bank branches

- Cheque Xpress/Cash deposit machines

- MEPS IBG at participating financial institutions

Payments are usually processed within 1–2 business days.

-

Log in to Alliance Online Banking or the Alliance Bank mobile app to view your latest balance, transactions, and e-statements.

You may also request printed statements via customer service for a small administrative fee.

-

Call the Alliance Bank credit card hotline (03-5516 9988) to check your application status. Provide your IC number or reference ID for faster assistance.

-

To increase your credit limit, download and complete the permanent credit limit increase form and submit it along with your latest income documents to any Alliance Bank branch or email it to info@alliancefg.com.

You can also use the allianceonline mobile app to apply.

Approval is based on income proof, repayment record, and credit assessment.

-

Yes. Alliance Bank offers Credit Card Auto Balance Conversion that converts your outstanding Credit Card balances to a 36-month installment automatically every 12-month basis at a lower effective interest rate of 13% per annum. You will be automatically enrolled if you meet all the eligibility criteria below:

- Malaysian nationality

- Annual income less than or equal to RM60,000

- Did not make a full payment for the credit card outstanding balance in the past 12 months

- Average credit card(s) repayment is not more than 10% of your total outstanding balances over the past 12 months

- Your credit card account’s current status is not delinquent

Another option is to avail of the Alliance Bank 0% Flexi Payment Plan. With a minimum spend of RM1,000, you can convert your purchases into 36-month instalments.

Contact Alliance Bank or check your online banking portal to activate an instalment plan.

-

Yes. Alliance Bank credit cards are accepted worldwide wherever Visa or Mastercard is recognized.

Important notes:

- The conversion rate and charges are determined by Visa or Mastercard.

- The charges are inclusive of a 1% foreign exchange conversion spread by Alliance Bank on all Alliance Bank credit cards except for the Visa Basic card.

- Enable “Overseas Transaction” via your app before travelling.

-

Immediately call the Alliance Bank 24-hour hotline at 03-5516 9988 to block your card and prevent unauthorized transactions.

You can also block your card instantly through the Alliance mobile app under “Card Management.”

-

You can reach Alliance Bank’s customer service via:

- Hotline: 03-5516 9988 (Mon–Sun, 24 hours)

- Email: info@alliancefg.com

Website: www.alliancebank.com.my

-

Yes. Supplementary cardholders earn the same cashback and Timeless Bonus Points as the principal cardholder. All rewards are consolidated under the principal account for easier tracking.

-

You will need:

- Copy of your NRIC (front and back) or passport

- Proof of income: Latest 1–3 months’ payslip or EPF statements

- Business registration and 6 months’ bank statement for self-employed

Additional documents may be requested during verification.

-

Currently, Alliance Bank primarily offers conventional credit cards. Only Islamic debit cards are available.

-

Generally, customers may apply and own more than one Alliance Bank credit card, provided they meet the eligibility requirements for each application. Confirm with Alliance Bank’s credit team or representative before submitting multiple applications.

-

(Last verified: Nov 2025)