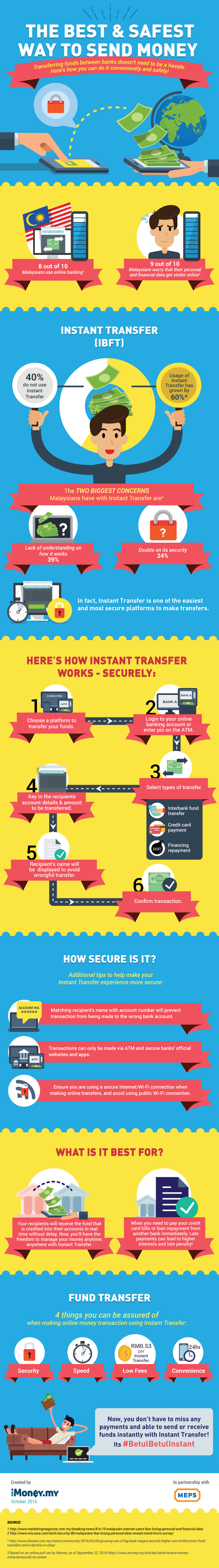

The Best And Safest Way To Instantly Transfer Money In Malaysia

A recent poll revealed the main reasons why Malaysians are not using Instant Transfer when they are performing electronic fund transfer. The two main reasons are: They lack the knowledge on how to use it (36.8%), and they are not confident of the security of the feature (26.4%). Other reasons cited include inconvenience (19.5%), and not user-friendly (17.2%).

However, the reality is that Instant Transfer, also known as Interbank Fund Transfer (IBFT) system is not only secure, but it is also convenient and easy to use. There are only six steps to transferring funds electronically and instantly (refer to the infographic).

It allows you to transfer money in real time through ATMs, online banking or mobile banking. Besides the usual money transfer, you can also use this service to pay for your credit card bills and loan repayments from another bank to avoid late payment. The added convenience only cost RM0.53 (inclusive of GST).

The best feature on the IBFT is the lack of room for errors in your funds transfer. During your transaction, you are required to key in the recipient’s bank account number, and the account holder’s full name will be displayed for your verification.

Why go through the hassle of going to the bank to transfer your funds, or having to wait for your funds to be transferred, when you can do it anytime, anywhere (even weekends)?