Great For Weekends, Collect Points Quickly

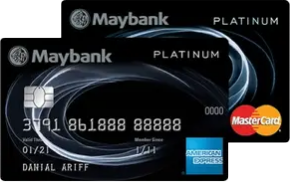

With the Maybank 2 platinum card, you get two cards with one sign up and one statement: the Maybank 2 Platinum American Express card and Maybank 2 Platinum Mastercard / Visa card

- a lifetime free waiver,

- 5x Treats Points for spend on weekdays with Maybank 2 American Express card,

- 1x Treats Point for spend on Maybank 2 Mastercard / Visa card,

- 5% Cashback2 on weekends with Maybank 2 American Express card, and

- many more.

Fees and Charges

There is no annual fee for the Maybank 2 Cards as it is waived for life including the supplementary cards. However, for this card there is a cashback limit of RM 50 per month and reward points that expire after 3 years from the month it was gained. If you settle your payments promptly on time with 5% of the outstanding or RM25 whichever is higher, you get to enjoy an incredibly low finance charge of 15% per annum. This card is beneficial if you are planning to conduct a balance transfer as there is a 0% rate for the 12-month plan. There's also 0% installment payment plan at all participating merchants.

Are You Eligible For The Maybank 2 Cards?

To apply for Maybank 2 Platinum Card all you need is just a minimum income of RM5,000, The minimum age requirement is at least 21 years old. For the supplementary cards, the minimum age requirement is 18 years old.

How to apply for a Maybank 2 Platinum card?

You can easily apply for the Maybank 2 Platinum cards right here.

Does the Maybank 2 Platinum card have airport lounge access?

No, the Maybank 2 Platinum cards does not offer lounge access.

Does the Maybank 2 Platinum card have travel insurance?

With the Maybank 2 Platinum cards, you get travel insurance coverage of up to RM700,000 when you charge your travel tickets in full to your Maybank 2 Platinum Card

What is the credit limit of Maybank 2 Platinum card?

Maybank credit card’s limit will be determined based on the individual credit assessment and the type of credit card applied by the customers including principle and supplementary card.

What are the required documents to apply?

Here are the required documents to apply for a Maybank credit card.

Salaried employee:

Copy of NRIC (both sides) or Passport

Latest 3 months' salary slips

Latest 6 months' savings account activity/current account statements

Self employed:

Copy of NRIC (both sides) or Passport

Income Tax Return (Form B/Latest EA form)

Copies of Business Registration Certificate/Trading License/ Form 9, Form 24, Form 49

Latest 6 months' company/personal Bank Statements

Expatriate:

Letter from employer confirming duration of employment contract in Malaysia

Note: You must be a Maybank account holder

Other options:

Looking for more options to choose from? Our credit card experts, also recommend you to check out other similar credit cards such as

If you prefer to broaden your credit card search, review more Maybank credit cards and start comparing today!

Petrol

Dining

Groceries

Shopping

Travel

5 TreatsPoints for every RM1 spent overseas or locally (Maybankard 2 American Express only) Other Features

Other Features