Kad Kredit AmBank

AmBank menawarkan banyak faedah yang hebat seperti pelancongan, promosi makanan dan juga hiburan. Kad AmBank MasterCard / Visa Infinite contohnya memberikan sehingga 5x mata bagi setiap pembelian dan juga makanan. AmBank juga tidak mengenakan pengecualian yuran tahunan terhadap kesemua kad mereka dengan syarat yang mudah. Bandingkan semua kad kredit AmBank sekarang dan daftar hari ini secara dalam talian.

Kami menjumpai 10 kad kredit untuk anda!

Inilah kad yang paling popular untuk rujukan anda!

AmBank Islamic Kad CARz Visa Platinum

Dapatkan 1 mata AmBonus untuk setiap RM1 perbelanjaan dan rebat tunai sehingga 20% untuk perbelanjaan di seluruh dunia.

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- RM80/bln

Pemindahan Baki kepada mana-mana Ambank kad kredit

Kategori Kad Kredit lain

Masih tidak pasti produk yang sesuai untuk anda?

Sila tinggalkan butiran dan khidmat pelanggan kami akan berhubung dengan anda!

Cara membuat permohonan dalam talian untuk kad kredit

Langkah 1

Gunakan Smart Search Kad Kredit kami untuk mencari senarai kad yang sesuai dengan keperluan anda! Pilih yang anda minati.

Langkah 2

Setelah anda mengisi maklumat anda, kami akan menghubungi anda untuk membantu anda memohon!

Baca lebih lanjut mengenai Kad Kredit

Soalan Lazim Mengapa kad kredit Ambank?

Kad kredit AmBank memberi anda akses ke pelbagai faedah eksklusif. Pasangkannya dengan program mata yang hebat, dan anda mempunyai pesaing untuk mendapatkan beberapa kad kredit ganjaran terbaik di Malaysia.

-

Kebanyakan kad kredit AmBank akan memberi anda Mata AmBonus untuk setiap perbelanjaan anda. Kad asas seperti kad AmBank Visa Platinum memberikan anda 1 mata untuk setiap RM1 yang anda belanjakan, manakala kad premium seperti kad Visa Infinite memberikan anda 5 mata untuk setiap RM1 yang anda belanjakan di luar negara.

Inilah cara anda boleh menggunakan Mata AmBonus anda:

- Tebus Enrich, Asia Miles, AirAsia, KrisFlyer air miles

- Tebus baucar untuk Isetan, Tesco, Giant, Cold Storage, Popular, Lazada, Grab, Agoda, Shopee, Zalora, Touch & Go eWallet dan banyak lagi

- Tebus barangan gaya hidup seperti telefon, iPad, aksesori komputer, peralatan dapur dan banyak lagi

- Bayar untuk pembelian di kedai-kedai yang mengambil bahagian

-

Apabila anda membeli-belah di kedai yang mengambil bahagian, anda boleh menukar pembelian runcit anda kepada Pelan Pembayaran Mudah 0%. Ini membolehkan anda memecahkan pembelian anda kepada ansuran bulanan yang lebih kecil sepanjang tempoh 6 hingga 24 bulan (tertakluk kepada kelulusan AmBank). Pelan ini tersedia di 700 kedai yang mengambil bahagian.

-

Kad AmBank Cash Rebate Visa Platinum menawarkan sehingga 8% pulangan tunai untuk barangan runcit, farmasi dan perbelanjaan dalam talian. Ini adalah kadar yang agak tinggi berbanding dengan kad kredit lain, menjadikannya kad pulangan tunai yang baik untuk perbelanjaan harian.

-

Kad premium AmBank, seperti kad AmBank Visa Infinite atau World Mastercard, menawarkan pelbagai keistimewaan eksklusif. Ini termasuk tawaran makan 1-untuk-1 di Hotel Shangri-La Kuala Lumpur, akses ke lounge lapangan terbang di lebih daripada 50 negara, manfaat makan dan penginapan di Club Marriott, insurans perjalanan percuma, perkhidmatan concierge dan banyak lagi.

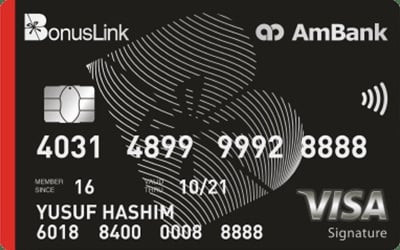

Tetapi anda tidak perlu memilih kad yang paling premium untuk menikmati keistimewaan ini. Malah kad AmBank BonusLink Visa, yang mempunyai keperluan pendapatan minimum bermula dari hanya RM2,000 sebulan, memberi anda akses kepada keistimewaan ini.

Selain itu, semua pemegang kad AmBank juga berhak mendapat promosi kad kredit bermusim. AmBank mempunyai katalog promosi besar untuk peniaga seperti Zalora, Lazada, HappyFresh, Agoda dan banyak lagi!

-

Hanya mohon sekarang dalam talian melalui iMoney. Pilih kad kredit yang anda inginkan dan isi maklumat hubungan anda dalam borang yang disediakan. Wakil kami akan menghubungi anda untuk membimbing anda melalui proses permohonan.