Kad Kredit CIMB

CIMB mempersembahkan beberapa pilihan kad termasuk untuk perbelanjaan, pulangan kembali petrol, pulangan kembali makanan dan juga jarak melancong. CIMB juga menawarkan program pindahan baki yang menarik kepada hampir semua kad mereka seperti menawarkan 0% kadar faedah selama 6 bulan tanpa yuran tahunan. Bandingkan kesemua kad kredit CIMB dan daftarlah hari ini secara dalam talian.

Kami menjumpai 9 kad kredit untuk anda!

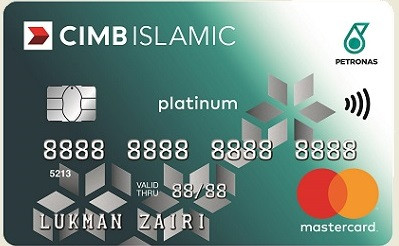

Inilah kad yang paling popular untuk rujukan anda!

CIMB Cash Rebate Platinum Kad Kredit

Berbelanja dalam talian atau untuk keperluan harian dan dapatkan sehingga 5% rebat tunai untuk barangan runcit, petrol, telefon bimbit dan utiliti.

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 5%

CIMB Kad World MasterCard

Terima 1.5% rebat tunai tanpa had untuk perbelanjaan di luar negara dan diskaun 15% di mana-mana peniaga bebas cukai.

- Gaji Minimum Bulanan

- RM 7,500

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

CIMB Kad Kredit Travel World

Pengembaraan lebih cepat dari anda sangkakan dengan Kad Kredit CIMB TRAVEL WORLD anda.

Kumpul Mata Bonus pada kadar pantas setiap kali anda berbelanja

- Gaji Minimum Bulanan

- RM 8,333

- Yuran Tahunan

- RM 554.72

- Pulangan Tunai

- -

CIMB Kad VISA Infinite

Teman makan dan perjalanan anda yang memberi anda 5X lebih ganjaran dan 8 kali akses lounge lapangan terbang.

- Gaji Minimum Bulanan

- RM 5,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 5%

CIMB Kad Kredit Travel Platinum

Pengembaraan lebih cepat dari anda sangkakan dengan CIMB TRAVEL PLATINUM dan nikmati pengecualian Fi tahunan.

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

CIMB Kad Kredit Travel World Elite

Satu-satunya kad kredit perjalanan yang anda perlukan dengan faedah perjalanan yang tiada tandingan!

Telah menerima anugerah '‘Best Credit Card for Affluent Clients (USD 70,000 AUM and above)' oleh Global Retail Banking Innovation Awards 2023.

- Gaji Minimum Bulanan

- RM 20,833

- Yuran Tahunan

- RM 1215.09

- Pulangan Tunai

- -

Pemindahan Baki kepada mana-mana CIMB kad kredit

Kategori Kad Kredit lain

Masih tidak pasti produk yang sesuai untuk anda?

Sila tinggalkan butiran dan khidmat pelanggan kami akan berhubung dengan anda!

Cara membuat permohonan dalam talian untuk kad kredit

Langkah 1

Gunakan Smart Search Kad Kredit kami untuk mencari senarai kad yang sesuai dengan keperluan anda! Pilih yang anda minati.

Langkah 2

Setelah anda mengisi maklumat anda, kami akan menghubungi anda untuk membantu anda memohon!

Baca lebih lanjut mengenai Kad Kredit

Soalan Lazim Mengapa kad kredit CIMB?

CIMB menawarkan pelbagai kad kredit yang memenuhi setiap gaya hidup. Dapatkan rebat tunai, batu udara, keistimewaan dan diskaun eksklusif, dan juga ganjaran berganda semasa menambah e-dompet anda!

-

CIMB menyediakan pendahuluan tunai mudah dengan pilihan bayaran balik melalui CashLite. Tiada yuran pendahuluan tunai atau penjamin diperlukan.

-

Kad kredit dari rangkaian pembayaran Visa dan Mastercard tersedia melalui CIMB, membolehkan anda memilih yang paling sesuai dengan keperluan anda. Terdapat kad kredit untuk setiap tahap pendapatan dan gaya hidup.

Jika anda seorang pengguna e-Wallet yang aktif, CIMB e Credit Card adalah untuk anda! Dapatkan ganjaran berganda dengan memperoleh sehingga 10X Bonus Points apabila menambah nilai e-wallet anda dan berbelanja dengan peniaga dalam talian seperti Zalora dan Lazada. Dapatkan bonus berganda apabila anda membeli-belah pada CIMB eDay.

Dapatkan rebat tunai tambahan untuk pembelian runcit, petrol, makan, atau hiburan bergantung pada keutamaan anda - atau kumpul mata air untuk simpanan percutian besar yang anda impikan. Promosi kad kredit CIMB membantu anda memperoleh apa yang anda mahukan. -

Tebus pelbagai jenis hadiah dengan CIMB Bonus Points - diperoleh apabila anda berbelanja dengan kad kredit CIMB anda. CIMB menawarkan nisbah penukaran mata bonus terbaik yang tersedia. Jadi, anda dapatkan apa yang anda inginkan lebih cepat.

-

Terdapat kad kredit untuk semua. Daripada pembeli dalam talian dengan CIMB e Credit Card, hingga kepada pendapatan rendah dengan kad kredit CIMB PETRONAS Platinum. Untuk mereka yang berbelanja tinggi, boleh memilih CIMB Visa Infinite Credit Card yang memberikan anda keistimewaan tambahan hanya dengan memegang kad tersebut.

Bagi mereka yang benar-benar istimewa, pertimbangkan CIMB Preferred Visa Infinite Credit Card, yang berfungsi sebagai CIMB Preferred Recognition Card dan menawarkan rangkaian keistimewaan dan faedah yang tiada tandingannya. -

Mohon secara dalam talian dengan iMoney. Pilih kad kredit yang anda inginkan dan isi butiran hubungan anda dalam borang yang disediakan. Wakil kami akan menghubungi anda untuk membimbing anda melalui proses permohonan.