Kad Kredit BSN

BSN menawarkan mata ganjaran istimewa terutamanya bagi Kad Emas BSN di mana pengguna boleh menikmati 2x mata ganjaran Happy apabila berbelanja dengan kadar 0% faedah bagi program pindahan baki mereka selama 6 bulan. Jadi, semak kesemua kad kredit yang BSN tawarkan dan daftarlah hari ini segera.

Kami menjumpai 10 kad kredit untuk anda!

Inilah kad yang paling popular untuk rujukan anda!

BSN MasterKad/ Visa Kredit Platinum

Nikmati apa sahaja yang anda mahukan dengan lebih tawaran, lebih ganjaran dan lebih kelebihan hanya dalam satu kad kredit.

- Gaji Minimum Bulanan

- RM 4,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

BSN Kad Kredit Emas

Nikmati ganjaran apabila anda melancong atau hanya duduk di rumah. Gunakan kad ini untuk membeli-belah, makan atau melancong pada bila-bila masa.

- Gaji Minimum Bulanan

- RM 3,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

BSN Kad Kredit Klasik

Dapatkan ganjaran Happy Rewards dengan pelbagai jenis perbelanjaan di 29 juta penyedia sambil menikmati kad Touch 'n Go BSN Zing PLUSMiles PERCUMA.

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

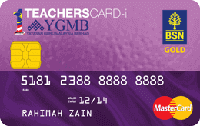

BSN Kad Kredit-i 1 TeachersCard MasterCard

Kad patuh Shariah yang ditempa khas untuk para pengajar di Malaysia. Terima ganjaran setiap kali anda berbelanja sambil mencarum sebanyak 0.2% kepada YGMB!

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

BSN Kad-i Klasik

Dapatkan ganjaran Happy Rewards dengan pelbagai jenis perbelanjaan di 29 juta penyedia sambil menikmati kad Touch 'n Go BSN Zing PLUSMiles PERCUMA.

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

BSN Kad 1 TeachersCard MasterCard

Kumpul dan tebus hadiah menarik melalui BSN Happy Rewards Programme - baucar, gajet, perkakas rumah dan banyak lagi!

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

BSN UUM-BSN Platinum Kredit Kad-i

Gunakan di lebih 29 juta peniaga dan 1 juta ATM di seluruh dunia dan nikmati Happy Points and pelbagai lagi kemudahan kad ini.

- Gaji Minimum Bulanan

- RM 5,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

Pemindahan Baki kepada mana-mana BSN kad kredit

Kategori Kad Kredit lain

Masih tidak pasti produk yang sesuai untuk anda?

Sila tinggalkan butiran dan khidmat pelanggan kami akan berhubung dengan anda!

Cara membuat permohonan dalam talian untuk kad kredit

Langkah 1

Gunakan Smart Search Kad Kredit kami untuk mencari senarai kad yang sesuai dengan keperluan anda! Pilih yang anda minati.

Langkah 2

Setelah anda mengisi maklumat anda, kami akan menghubungi anda untuk membantu anda memohon!

Baca lebih lanjut mengenai Kad Kredit

Soalan Lazim Mengapa memohon kad kredit BSN?

Kad kredit BSN melayani mereka yang menikmati simpanan semasa menggunakan kad kredit mereka. Mereka menawarkan pelbagai potongan untuk pelanggan, dengan keistimewaan tambahan bagi mereka yang memerlukan sedikit tambahan sesuatu yang istimewa.

-

Satukan pembayaran kad kredit anda dalam satu bil bulanan dengan kad kredit BSN anda. Program Pemindahan Baki BSN memudahkan anda untuk menyatukan pembayaran anda, sementara Program Penukaran Baki Automatik memberi anda bil bulanan yang lebih rendah berbanding produk pesaing.

-

Dapatkan kad tambahan percuma, pulangan tunai, dan keistimewaan hebat dari peniaga di seluruh negara. Manfaatkan Pelan BSN EasyPay untuk membuat bayaran ansuran tanpa faedah pada pembelian anda. Seimbangkan bajet anda dan kurangkan bebanan perbelanjaan yang tidak dijangka.

-

Tukar Ganjaran Happy BSN anda kepada Enrich Miles atau AirAsia BIG Points. Berbelanja dengan kad kredit anda untuk mendapatkan penerbangan ke destinasi impian anda.

-

BSN menawarkan Kad Kredit BSN G-Card Visa dan BSN-Teachers Mastercard Gold untuk diskaun tambahan dan keistimewaan kepada penjawat awam dan guru. Dapatkan ganjaran atas khidmat anda kepada negara.

-

Cukup buat permohonan secara online dengan iMoney. Pilih kad kredit yang anda inginkan dan isi butiran hubungan anda dalam borang yang disediakan. Wakil kami akan menghubungi anda untuk membimbing anda melalui proses permohonan.