Squeeze more out of your money.

Get your finances into shape with the best promos, rates, and expert tips and tools.

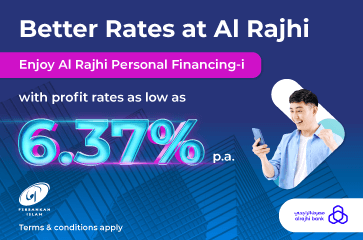

Deals this week

Save more for things that matterOur top picks this month

-

Are you a fan of Artificial Intelligence (AI)

Amp up your portfolio with 0.01 Nvidia Share* when you make a debut trade on any NYSE/NASDAQ stocks with Rakuten Trade from 1 – 20 April! *T&C Apply

-

Best Credit Cards

Limited Time, Maximum Thrill!

Elevate Your Everyday, Enjoy Limitless Benefits. Apply Credit Card Today & Claim Your Exclusive Gift *Terms and Conditions apply.

Money tips for you

Make good decisions

Get even more financial clarity with an iMoney account for FREE

We’ve tailored insightful tidbits just for you.

Tools and Calculators

To manage your money better

We have helped over 2 Million Malaysians

find the right products for their needs

Take charge of your money with us - 100% free