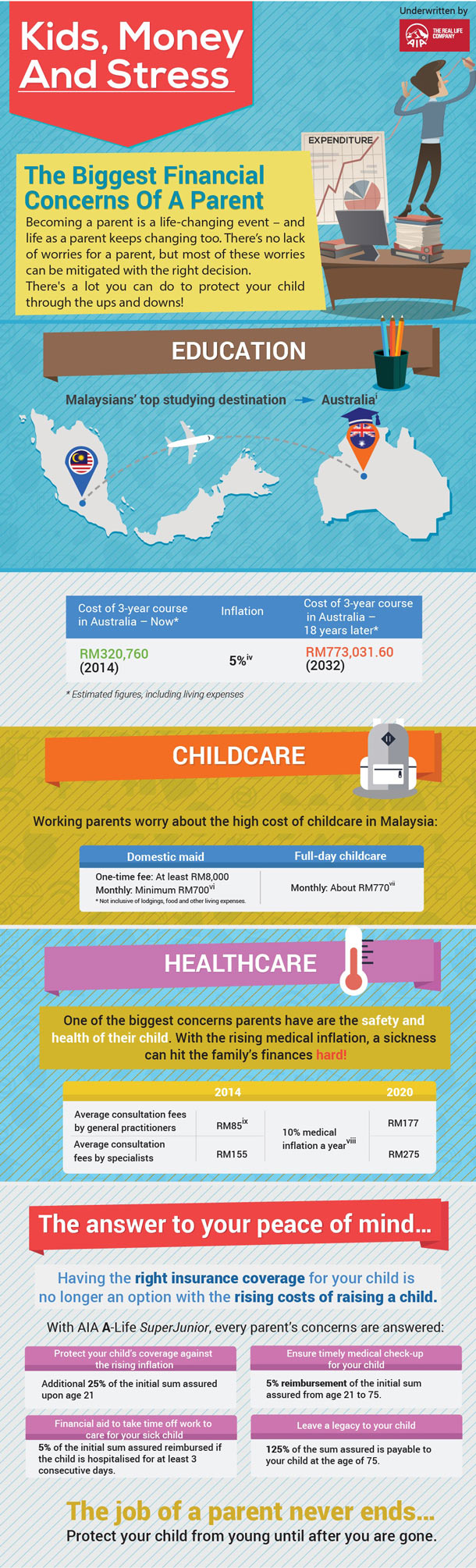

The Parenting Worries: Kids, Money And Stress

Parenting can be wonderful and rewarding, but it can also be difficult and worrisome, especially with the cost of raising a child being so high. Being a parent basically means being responsible of your child for the rest of your life, even when the child has grown up and is living his/her own life.

One of the biggest parenting worries is the safety and well-being of their children. If given a choice, parents would want to protect their children even after they are gone. In reality, there are no guaranteed methods for ensuring our children will be happy, healthy, and successful in life.

However, there are certain protections we can put into place to make a significant and positive difference in our children’s lives. Sometimes giving the best to your children takes long-term planning and fore thoughts.

The truth is, in today’s economic situation and also lifestyle, a single unfortunate incident, like your child having a pro-long sickness, can easily put the family into bad financial debt. Parents may want to put their lives on hold to care for the child, and also to be able to afford the best treatment to nurse the child back to health.

However, without the right and adequate protection in place, this may seem financially impossible for most families.

By making the right choice of insuring your child early on, it may make a significant difference in your child’s and your family’s life.