In the recent years, the development of entrepreneurship has been growing in importance in Malaysia. This is evident that the Government places great importance on entrepreneurship in the country with the various supporting mechanisms and policies that exist for entrepreneurs in terms of funding opportunities, physical infrastructure and availability of business advisory services.

To implement sustainable programmes to elevate the Rakyat in their earning power, and also to encourage innovation, especially among the Bumiputera, Budget 2015 has allocated a substantial amount of money to boost the development of this sector.

Currently, SMEs contribute 33% to GDP and the share is targeted to increase to 41% by 2020. In line with that, the entrepreneurship sector to see increased financing avenues, GST exemptions and tax advantages allocated to them under the Budget 2015.

1. Increased financing

The biggest risk of starting a business is the initial capital. Some have it but do not have the business acumen, while others do not have the funds but have great ideas.

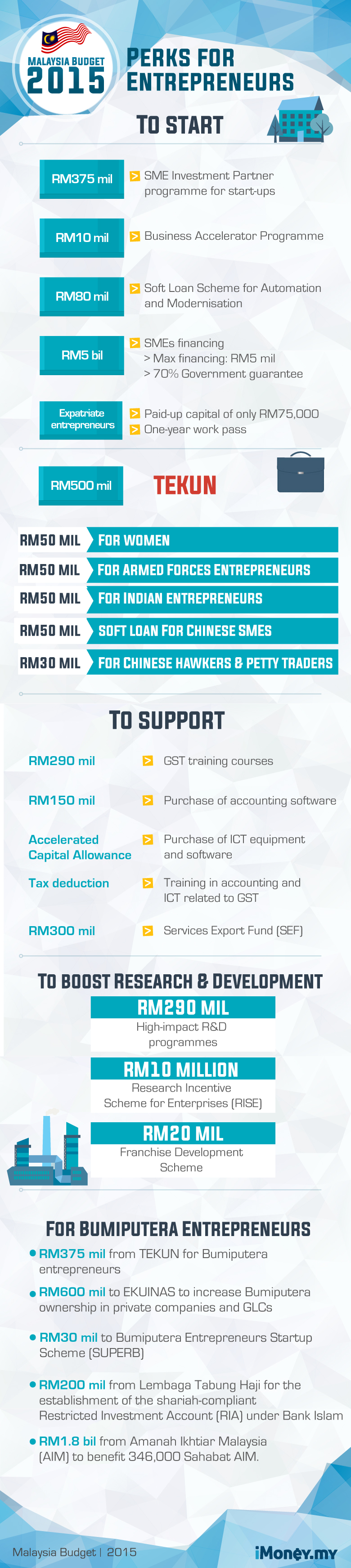

To help those who are struggling with their startup capital, the Government is set to introduce SME Investment Partner programme to provide financing during the start-up period in the form of loans and/or equity. To serve this purpose, an initial fund of RM375 million will be provided for a period of five years. Furthermore, RM10 million will be allocated for the Business Accelerator Programme.

More financing of RM80 million will be allocated under Soft Loan Scheme for Automation and Modernisation of SMEs.

In addition to that, RM500 million will be allocated to TEKUN and it will be distributed as follows:

Soft loans of RM50 million for Chinese entrepreneurs and RM30 million for Chinese hawkers and petty traders.

Under Malaysian Global Innovation & Creativity Centre (MaGIC), expatriate entrepreneurs will be able to establish a start-up in Malaysia with the paid-up capital set at RM75,000 and will be provided with a one-year work pass.

2. Increased opportunities for Bumiputera Entrepreneurs

Bumiputera entrepreneurs to see added benefits, as follows:

- RM600 million allocated to EKUINAS to increase Bumiputera ownership in private companies and GLCs.

- Strengthening the role of the National Entrepreneurship Institute (INSKEN) as a Centre of Excellence for Bumiputera Entrepreneurship.

- Additional allocation of RM30 million for Bumiputera Entrepreneurs Startup Scheme (SUPERB), and this programme will be extended to entrepreneurs in Sabah and Sarawak.

- Pre-export programme for high-performing Bumiputera companies (TERAS) for enhanced branding, international certification and market surveys for Bumiputera products.

- Expanding carve-out and compete programme through meritocracy for Government and privatised projects including MRT second phase and Pan-Borneo Highway.

- RM200 million allocated to Lembaga Tabung Haji for the establishment of the shariah-compliant Restricted Investment Account (RIA) under Bank Islam. The purpose of RIA is to provide financing and credit between RM50,000 and RM1 million.

- RM1.8 billion allocated to Amanah Ikhtiar Malaysia (AIM) to finance 346,000 Sahabat AIM.

With these new programmes and financial aids to help Bumiputera entrepreneurs kick-start their businesses. Just like the old adage, give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime.

3. GST assistance

In order to help the entrepreneur sector in absorbing GST, the Government will be providing them the following incentives and assistance:

i. RM100 million provided to businesses to send their employees for GST training courses.

ii. RM150 million provided to SMEs for the purchase of accounting software.

iii. Accelerated Capital Allowance provided on purchase of ICT equipment and software.

iv. Expenses incurred for training in accounting and ICT related to GST is subjected to tax deduction.

Implementing GST can be a major change in a business. With this help, it will make it easier for businesses to adapt.

4. Income tax advantages

Under the 2016 assessment year, the corporate taxes to be reduced by 1% to 24% and SMEs taxes to be reduced by the same percentage to 19%.

This will lessen the burden of the rising cost to run a business, and prevent any increment in cost to be passed down to the consumers.

5. Improving the services sector

In their efforts to improve services sector, the Government plans to implement the following in the next financial year:-

- Services Sector Guarantee Scheme amounting to RM5 billion for SMEs, with a maximum financing of RM5 million and 70% Government guarantee. The scheme is expected to benefit 4,000 SMEs.

- Research Incentive Scheme for Enterprises (RISE) with an allocation of RM10 million to encourage companies to set up research centres in high technology, ICT and knowledge-based industries.

- Services Export Fund (SEF) of RM300 million to encourage SMEs to conduct market feasibility studies and undertake export promotion to penetrate new markets.

- Strengthen the Franchise Development Scheme under the Ministry of Domestic Trade, Co-operatives and Consumerism in collaboration with the Malaysian Franchise Association. RM20 million is allocated for the scheme.

5. Improve quality of SMEs products to be competitive globally

The Government targets to see 360 high-impact innovative products to be commercialised within the next five years. In order to achieve this target, they will be providing research funds amounting to RM290 million to implement various high-impact R&D programmes.

In view of globalisation and increased competitiveness, it is timely to strengthen entrepreneurship in Malaysia. The key aim should be to encourage the local entrepreneurship to have a more global outlook. With 2015 being a great year for entrepreneurs to take advantage of, we hope to see more competitive global entrepreneurs formed in Malaysia with brighter opportunities for growth and greater cost savings for businesses.

The importance of home-grown businesses cannot be overlooked. With these allocations to boost entrepreneurship in the country, this will make the products and services made in Malaysia more competitive and efficient.

This is undoubtedly the year for entrepreneurs.