For many investors, investing in unit trust has been challenging. Despite holding the investment for many years, they have not been able to achieve satisfactory return.

I would like to share some best practices that have been developed over the last two decades of my advisory experience to support investors to build and maintain a profitable unit trust portfolio.

If you apply all these best practices correctly, you should be able to reduce unnecessary risks and even enhance your portfolio returns.

So, if the mission is to build a successful unit trust portfolio, where should you start?

1. Set your target return

As with any task you embark on, the first step is to understand your goals, which in this case is your target returns. What range of ROI are you looking to build in your portfolio?

If you expect to get 8% on your annualized investment returns, you don’t want to put all your units into bonds and money market funds. A portfolio like this is very unlikely to give you an 8% return over the long run.

Instead, your portfolio should comprise at least 50% equity funds. This may sound like obvious advice, however, you’d be surprised to discover how many investors are holding a unit trust portfolio that is not at all aligned with their target ROI.

2. Determine your asset allocation

While deciding the breakdown of the asset allocation of your investment portfolio, it is important to ask yourself the following questions:

- What is the split among the key asset classes such as equities, bonds and REITS?

- Is this ratio suitable for your risk profile and age?

- What is your exposure to local, regional or global equities?

- Should alternative assets such as gold or commodities feature in your asset classes?

Once the ideal asset allocation has been determined, the next question one should ask is, does it fit in the current environment?

If the ringgit is weakening, it may be better to widen your exposure to foreign investments. This diversification may increase your risk-reward ratio. By diversifying overseas, investors are also able to capitalise on stronger currencies while tapping into the growth potential of multinational corporations with access to larger markets.

For example, a client once invested RM200, 000 mainly in Malaysia small cap funds which has seen its performance fluctuate up and down. Following our advice to diversify to more asset classes overseas, my client is now able to tap into more opportunities and enjoy better return.

3. Invest only in best-of-breed funds

This is a very important step for amateur and novice investors to ensure you’re capitalising on your return potential. Many are unknowingly duped into picking the best fund from one unit trust management company, instead of picking from a wider selection across all the different unit trust management companies in the market.

If you are investing in one category of investments, you should aim to select the best option available (with similar risk levels) from across all the different unit trust management companies in the market, rather than the best performer in just one unit trust management company..

To be certain that you choose the best-of-breed financial products, a little basic knowledge about your options is needed.

- Know what category the investment option falls into

Is it equities, fixed income, commodities, real estate or alternative assets? From there, list down a few available investment funds from that same category. The key word here is same category, not same unit trust management company.

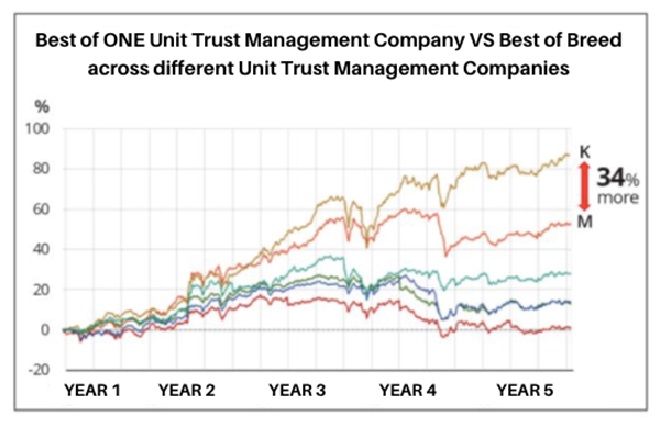

For example, if you wish to invest in a Malaysian equity growth fund and you approach an agent at company “P” who highly recommends Product “M” as the best performing fund in the company – is that really the best fund available in the category of Malaysian equity growth fund?

However, if you were to compare other funds from other companies in the same category as Fund “M”, you may realise that Fund “M” is mediocre at best when compared to Fund “K” from a different company, over the same period. Therefore, what looked like the best option initially, can turn out to be otherwise when you make the right comparisons.

- Know the people behind the fund

It is also worth noting that performance of the fund alone should not be the sole indicator to narrow down the best-of-breed selection.

There are other factors to consider, such as the people behind the fund management team and the robustness of the investment process.

- Understand the options out there

On one end are unit trust management companies which distribute their own financial products under one umbrella brand and do not cross-sell other companies’ products. Clearly these restrictive conditions are hardly conducive to provide an investor with best-of-breed investing opportunities.

On the other end of the spectrum are independent platforms bearing an “open architecture” model, where investors can access most funds available in the market with limited barriers. To profit on these platforms, investors can either go for Do-It-Yourself (DIY) investing (which has its own set of challenges and risks) or opt for the investor-assisted route, such as by going through a licensed Independent Financial Advisor (IFA).

By taking a little time to analyse and select your best-of-breed funds across the whole unit trust fund market before making the purchase, you stand to get better value for the same price and same risk level. In some cases, you may even get an additional 50% return or more!

Book your FREE 1-hour unit trust portfolio review with WHITMAN Independent Advisors.

Looking for ways to enhance your unit trust portfolio returns?

What is the best way to maintain your portfolio?

Investing into a portfolio of unit trust funds, is just the first step of many, to grow your hard-earned money.

Maintaining one, is an entirely different ball game. It requires some amount of work and due diligence. Next, I would like to share best practices in maintaining a profitable unit trust portfolio.

- Rebalancing your portfolio

Firstly, proper portfolio maintenance involves periodic rebalancing, i.e. the process of realigning the weightings of asset classes in their portfolio. This is done by buying or selling funds in a portfolio to maintain the original desired level of asset allocation.

For example, say the original target asset allocation is 60% equities and 40% bonds. In a bullish market, the equity portion of the portfolio could increase to 80%. To rebalance this portfolio, an investor would sell some of his equities to reap the profit and buy more bonds, thus shifting the portfolio back to the original target allocation of 60:40.

Why do this at all? Rebalancing is necessary to ensure the amount of risk involved is maintained at the investor’s desired level. Besides giving investors the opportunity to sell high and buy low, rebalancing also allows investors to take the gains from good performing investments and reinvest them in areas that have not yet experienced such notable growth.

- Taking profit from your portfolio

Secondly, investors should know when to sell the gains and capture the profits while leaving the principal intact. When a market experiences correction, you can reinvest the profits to take advantage of buying low. You may even consider selling off some, if not all your investments, so that the money can be channelled into other more suitable investments. At the end of the day, it is important that you know your options in order to derive the best possible outcome.

The last thing you’d want is to be devoid of any options. This could potentially occur if you do not regularly check on the fund’s performance, resulting in you being unaware when there is profit to gain. As a result, whatever profit gained may get eroded away as the performance dips over time.

- Cutting and replacing underperforming funds

Thirdly, when maintaining your portfolio, you must always replace underperforming funds with better alternatives. Investors can measure their investment performance in Malaysia by comparing against the benchmark index to ascertain if the fund in question is performing well in absolute terms or only performing better relative to its benchmark.

Ask yourself how much you are getting in total returns, taking into account both the income distributions received and price changes. Should a fund declaring regular distributions continue in your investment portfolio despite giving negative total returns?

On its own, a fund’s performance may look good. But does it measure up equally well to its peers, i.e. other funds with a similar objectives, geographical markets or sectors?

If you’ve identified that your investment is indeed underperforming, then what’s next? Do you sell immediately to minimise further losses or adopt the wait-and-see approach, hoping that the fund will eventually turn around? If you decide to switch to a better performing fund manager, would it incur additional costs?

All said, your unit trust investment portfolio is an integral part of your financial plan. But like cars, they would require regular servicing and tune- up for it to operate at peak performance.

The uncertain future, brought about by the pandemic, and constant changes in the investment environment continues to challenge investors. So, do keep on top of your investments to ensure that the time and effort spent to acquire your wealth is worth the while.

Want more information on your unit trust investments? Book your FREE 1-hour review with WHITMAN Independent Advisors here.