Buying an auctioned property can be a smart investment choice as these properties can be obtained at a fair or below market value without having to go through any long drawn negotiations between the seller and buyer. As such, the time required to purchase a property is shorten and the risk of abandoned housing developments can be avoided.

It is advisable for you to know the basic auction process, understand all the terms and conditions involved and do enough homework prior to the bidding, to avoid costly pitfalls.

Buying an auctioned property is by no means easy. The following 10-steps explains the processes, terms you should understand and loopholes to look out for.

1. Identify a property

You can identify a suitable property according to your preferred location and budget through the local newspaper or property-related websites. A notice for a sale is advertised in the local newspaper two weeks prior to the actual auction date. You can also obtain information from bank websites or online property websites such as iProperty.my, LelongTips.com, AuctionMart.my, etc.

Before the Auction Day

2. Run inspection on the property

A. Title of property

Check at the local land office on the status of the title, in order to identify the rightful owner of the property.

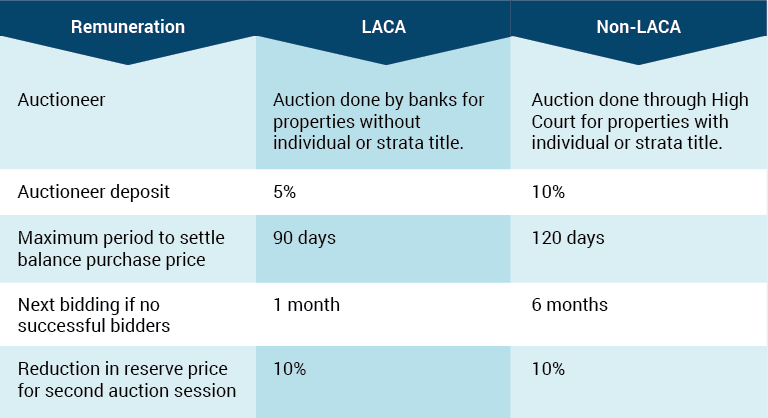

This information will enable you to know if you are bidding in a Loan Agreement cum Assignment (LACA) or non-LACA auction. A LACA kind of sale is done by the banks for properties without individual or strata title. On the contrary, a non-LACA sale is done through the High Court for properties with individual or strata title.

It is important to identify which category you will be bidding in because the auctioneer deposit and balance purchase price settlement period differs for both (this is explained at the later part of the article).

You also need to consult your lawyer on whether a private caveat has been lodged on the title of the property. Removal of the caveat requires court order and therefore incurs cost.

B. Condition of property

Then, pay a visit to the property to conduct an external inspection of the property. This is to check the condition of the property and the surrounding neighbourhood. If the property is vacant, find out from the auctioneer whether you can view the interior of the premises before you bid for it. If the property is occupied, speak to the present tenants as to whether you can view the interior of the property or what they can tell you about the physical condition of the property.

If you are unable view the interior of the property, you may you may have to allow for repair cost as the exact condition of the property cannot be ascertained

Having this information will help you decide if the property is a worthwhile purchase.

C. Vacancy of property

If the property is not vacant, you must be prepared to legally evict occupants out of the property. Once you are officially the owner of the property, you can apply to distress the occupants through a lawyer before you obtain a court order. However, this can be a hassle as it consumes time and additional costs are incurred. Alternatively, you can speak to the occupant politely and get them to move out by themselves. If the property has occupants, you can also offer to rent out the property to them.

3. Obtain Proclamation of Sale (POS) and Conditions of Sale (COS) from auctioneer

After getting a copy of the POS and COS from the auctioneer, make sure you read and understand all the terms and conditions stated in both those documents. If you have any doubts or enquiries, you can contact the auctioneer for further details.

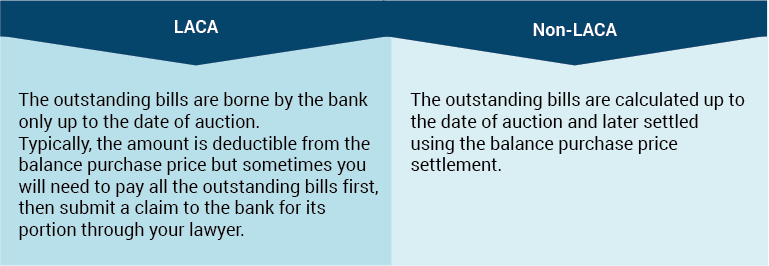

Primarily check if the property has any outstanding bills like quit rent, assessment, maintenance charges, and utility bills yet to be settled. Find out which party is responsible for these bills.

LACA and non-LACA have different terms for the payment of these.

However, look out for clauses on payment of outstanding bills as there are also foreclosed properties which require you to bear all the outstanding charges. Some banks may also put a limit of claims on outstanding bills of up to not more than 10% of the reserve price, any excess of outstanding charges will be borne by you.

4. Prepare auctioneer deposit

You will need to prepare a bank draft or cashier’s order for the deposit amount equivalent to either 5% (for LACA) or 10% (for non-LACA) of the reserve price (the lowest price or the starting price the seller will accept).

5. Prepare all relevant documents

You will need to prepare the following documents:-

Individual Bidders

- Original and a photocopy of the bidder’s identification card (MyKad).

- A bank draft or cashier’s order equivalent to 5% or 10% of the fixed reserve price payable to the auctioneer.

- Additional funds to pay the difference between reserve price and successful bid price (5% or 10% of the successful bid price).

- Letter of authorisation if you are bidding for someone’s behalf.

Corporate Bidders

- Company’s Memorandum and Articles of Association (M&A) – certified true copy by Company Secretary.

- Form 24 and 49 – certified true copy by the Company Secretary.

- Board of Director’s Resolution – certified true copy by the Company Secretary.

- Letter of authorisation (with letterhead, company stamp and signed by at least one director).

- Photocopy of director(s)’ MyKad.

- Identification card (MyKad) together with a photocopy of MyKad (both sides) of person being authorised to bid.

- A bank draft or cashier’s order equivalent to 5% or 10% of the fixed reserve price payable to the auctioneer.

- Additional funds to pay the difference between reserve price and successful bid price (5% or 10% of the successful bid price)

On the Auction Day

6. Arrive early

On the auction day, arrive 30 minutes earlier and register at the auctioneer registration counter. At the counter, deposit your bank draft or cashier’s order.

7. Auctioneer briefing

The auctioneer will announce the commencement of the auction, provide a briefing on the bidding process and read out the important clauses in the COS and POS. It is important to listen to the proceeding very carefully to avoid unawareness and ensure that everything is according to the COS and POS issued to you prior.

8. Start bidding

As a bidder, you need to raise your bidding card (which will be provided to you) to indicate your bidding price. The bidding process will stop when the highest price is called out three times by the auctioneer and no further bids are made. At the fall of the hammer, the property is officially sold.

9. Successful or non-successful bidding

If you are not the successful bidder, you may redeem your bank draft or cashier’s order at the registration counter immediately after the auction.

If you are the successful bidder, then you will be required to sign the Contract of Sale and pay the difference on the deposit sum between the successful bidding price and the reserve price, if there is an increment in bidding price. Before you sign the contract, make sure all the details provided are correct.

After the Auction Day

10. Settlement of balance purchase price

As the successful bidder, you will be required to settle the balance of the purchase price within 90 days for LACA auction or 120 days for non-LACA auction.

At this point, you will need your lawyer to act on your behalf to smoothly execute the transfer of the property ownership.

It would easier if you have the cash to pay the balance purchase price. However, like most people, if you intend to take up a loan for the property, you will need to act fast as the release of payment from your financing bank can be rather slow. This is to prevent your auctioneer deposit from being forfeited due to late payment of the balance purchase price. Prepare all the required documentations before the auction to facilitate the loan application process.

10 steps to buying an auctioned property

Take note of the difference between a LACA and a non-LACA auctioned property:

Note: You cannot participate in an auction if you are a minor of below 18 years and has been declared bankrupt.