Interest rates on home loans are still hovering near record lows at Base Lending Rate (BLR) 6.6% (the lowest rate ever was 5.55% in 2009), but experts say rates aren’t expected to stay this low for much longer.

Update: On July 10, 2014, Bank Negara Malaysia (BNM) announced an increase in the Overnight Policy Rate (OPR) by 0.25%, resulting in an increase in the BLR to 6.85% by most major banks.

BNM had also announced a new interest rate framework known as the Base Rate that is set to replace the current BLR rate in 2015.

In layman’s terms, the current lending rate is the base interest rate that banks refer to internally before deciding how much to charge (i.e. interest rate) for your home loan. However, a more accurate definition of BLR is that it is a rate set by the central bank based on how much it costs to lend money to other financial institutions. The cost to borrow money is determined by the Overnight Policy Rate (OPR) set by BNM.

Though the central bank reassured the public that this new framework is merely a change in the system and is not expected to impact the general level of domestic interest rates, most home buyers are still sceptical on how it will affect their loans and repayments.

But do we really know what it means and how it will affect our bottom line? Here, we lay it out for you. Let’s look at how the new rate can ultimately affect consumers.

Why the change?

According to BNM, the new framework will enable customers to make better financial decisions as this new framework encourages greater transparency from the banks.

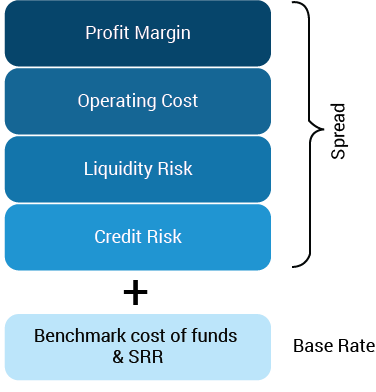

The Base Rate will be determined by the financial institutions’ benchmark cost of funds and the Statutory Reserve Requirement (SRR). Other components of loan pricing such as borrower credit risk, liquidity risk premium, operating costs and profit margin will be reflected in a spread above the new framework.

Hypothetically, it should differ from bank to bank depending on their performance. The better performing one will be able to offer more attractive and competitive rates for their customers. So instead of the fixed rate we see now, each institution will have a different rate forcing them to be more competitive to offer the lowest rates to the customer.

Is it good or bad?

Better transparency always spells good news for consumers. It is also good for the banks as it creates healthy competition and provides wider options for loan applicants.

According to BNM’s press statement, the new reference rate will also better reflect changes in cost arising from monetary policy and market funding conditions, while encouraging greater discipline and efficiency among financial institutions in the pricing of retail financing products.

“This is a positive step forward by Bank Negara to allow banks to align loan pricing based on funding structure, cost efficiency and credit risk management. Further refinements are required and being worked on, but we see this as positive progress,” Renzo Viegas, CIMB Bank chief executive officer for consumer banking, told the New Straits Times.

Given the flexibility to determine their respective benchmark rates, the smaller institutions may risk losing out on the rat race of getting more borrowers for loans.

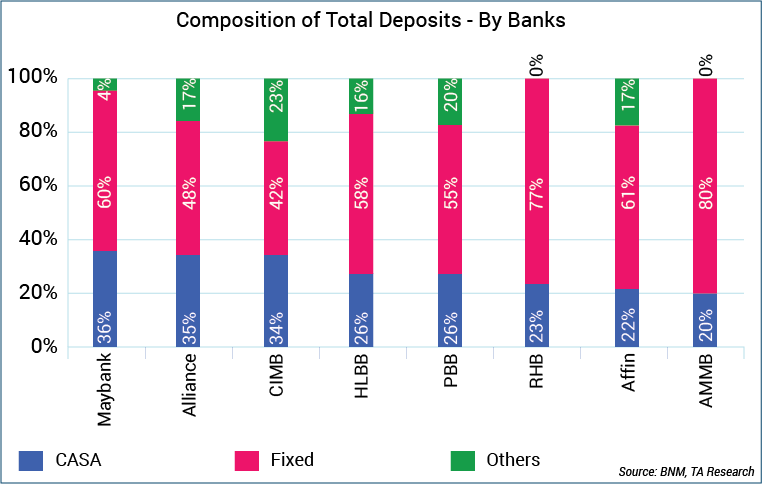

Bigger establishments will have more room to maneuver when determining the reference rates, whereas smaller institutions may not have as much leeway to offer attractive rates. This is due to the usually lower cost of funding for bigger institutions via current and savings accounts (CASA) and Fixed Deposit accounts.

How will it affect you?

Brushing all the jargon aside, “how will the new reference rate affect my loan?” is the question most people have.

The central bank has reiterated in its media release that the shift towards the new reference rate framework should not have an impact on the effective lending rates charging to retail borrowers.

For home owners with existing home loans, the BLR-based loans (non-fixed rate loans) will continue to be referenced against the current lending rate after 2015, until the financial institution makes any adjustment to the base rate, which will then be adjusted accordingly.

“As such, financial institutions will be required to display both their base rate and BLR at all branches and website,” said Tan Sri Dr Zeti Akhtar Aziz, the governor of BNM, during the launch of the central bank’s annual report of 2013.

However, for new loan applicants and refinancing applicants, the new rate framework will have a direct impact on the rates after January 2, 2015.

Amidst the uncertainties on the rates, homebuyers should always be a step ahead by comparing all the rates from banks before making a decision on which loan to apply for. For those who fear higher rates after the implementation of the new rate, you can safeguard your low rates now by switching or getting a fixed-rate loan. Doing so can also remove some of the intimidation factors from the home buying process.

Share with us your thoughts on the new Base Rate framework.